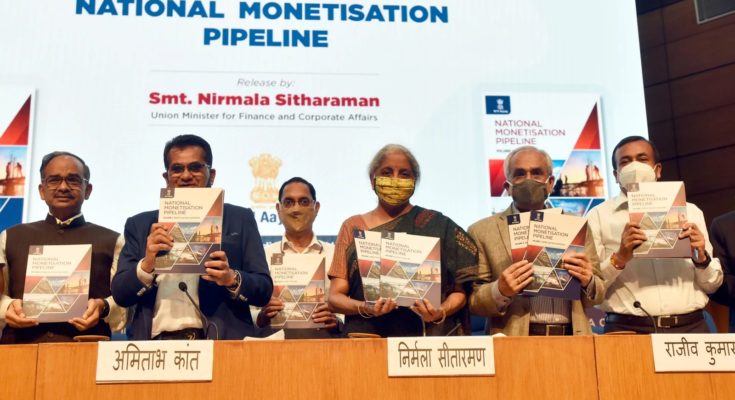

New Delhi, September 15, 2021: The two day online meeting on National Monetisation Pipeline – “Call it by its name! The National Monetization Privatization Pipeline & the Return of the Company Raj”, was organised by Financial Accountability Network India and People First on 13th and 14th of September. This meeting was an attempt to unmask what this “monetization” really entails for the common people and workers; and to register our protest against such pro-business moves with complete disregard to the interest of the Republic and its people. Through the NMP brownfield assets to the tune of 6 lakh crores would be ‘leased’ out between 2021 and 2025. These include roads, railway stations, trains, airports, ports, transmission lines, stadiums and telecom. This crucial decision that would have direct and detrimental impact on the people and the economy was taken without any discussion in the parliament.

Political representatives, activists, economists including Former Finance Minister of Kerala Com. Thomas Isaac, Chairman of AICC Technology & Data Cell Mr. Praveen Charkravarty, Com. Kanhaiya Kumar, Prof. Arun Kumar, Prof. Chirashree Dasgupta, Mr. S Nagalsamy, Beena Pallikal, Priya Dharshini, Mr. Sharat Kumar spoke about the various aspects of the proposed pipeline. It was also joined by Manoj Jha (RS member, RJD) and Jawhar Sircar (RS member, TMC) over video. The two day meeting was moderated by Prof. Dinesh Abrol and Mr. Nitin Sethi respectively and had a wide range of participants.

Thomas Isaac, the former Finance Minister of Kerala and a Central Committee member of CPIM at the very outset laid out how the distinction being made by the government between monetization and sale is a hogwash. He said “the govt is claiming they are giving only temporary rights for a certain duration. Now the companies would definitely be investing on these assets. The key question is how will govt repay this investment that the private companies have made at the end of the period when they take back the assets. If the government says that whatever the investments the private players make, would be taken over by the government at the end of the tenure, then there would be no takers. So, basically the govt would be virtually extending the lease in perpetuity.” Finally he said “no companies are going to invest from their savings, rather they would borrow and new financial institutions will come up to finance these purchases. So essentially, public money will be raised to finance private assets.”

Praveen Chakravarty, the Chairman of the AICC Technology & Data Cell, called into question both the intent and timing of the announcement. He said that the idea of putting big capital assets on the block at a time when the economy is extremely weak, when private investment is very constrained is only to favour a few big players as no one else will have the money now to invest in these assets. He emphatically said that is this nothing but an attempt to ensure “backdoor entry for the friends of the government in the facade of the monetisation policy.”He further added that during the pandemic government was able to use railway at its disposal to transport migrant labourers and questioned that such a scenario would not be possible if the railways were private. He also brought in the global context where during the pandemic governments have actually increased spending and resorted to direct cash transfers online with the keynesian economics to revive demand. He pointed out the irony in the FM’s statement that the government is planning to raise 6 lakh crore (1.5 lakh crore per year) and the FM stating in another press conference that the government is reducing corporate tax, thereby loosing exactly 1.5 lakh crore!

Jawahar Sircar, the Rajya Sabha member from TMC, raised the crucial questions of valuation of the assets to be monetised and that it has to be in the public domain. He further pondered on the state leased lands which have been used by PSEs with conditionalities and if the NMP will be in conflict with the state policies. He also suggested the need for a declaration from beneficiaries that there is no conflict of interest as it is known that the ruling party has raised funds from big corporations. He raised alarm bells to ensure that the assets are not leased to anyone on a quid pro quo basis.

Beena Pallical who is the Genereal Secretary of the National Campaign on Dalit Human Rights, focussed on the impact of this decision on the most marginalised. She sad that the number of poor have almost doubled over the pandemic. “How can under such a circumstances we allow a few private players to take over the assets built with tax pacers’ money.” She said “Much of the public sector infrastructure provides livelihood option for many from the marginalised communities, like railways, roads construction and so on. Also the affirmative action, like reservation, is pegged on the public sector. There is no clarity as to how these are going to be affected when these go into private hands.”

Manoj Jha, the Rajya Sabha member from RJD, said “We are not against the market, but if we are going to bend our knees to market, then that is a big problem. Railway, insurance sector, you are giving up these to market? Railway track to wreck, station, you are selling everything. You think you are good in naming things, you are calling it monetization”, but the people of the country must come out and must stop this sale.

Prof. Arun Kumar, known macroeconomist and former professor of JNU, re-emphasized the significance of a large public sector in a poor country like India. “Because when the market fails, you need the state to come in. In the pandemic also this was demonstrated. Because in such moments of crisis what we need is a sense of collectivity which is not possible when assets are in private hands.” He warned that such a move will only add to inflation, unemployment, and inequality and will hamper reservation. As to whether this is the only means to raise resources, he said the govt can raise the money otherwise also. For example, it can put taxes on the stock market.

Kanhaiya Kumar, the National Executive Council member from CPI, spoke of his experience of witnessing such debates in the villages he would tour. The ones against said that the govt says “We won’t allow the sale of the country”, but the country is made of our national assets. You say that we won’t sell the car and on the other hand you are selling the parts of the car! “Let’s for a moment take that the government is not selling, but mortgaging. Then why? With whom? and for how much? Say if I have to sell my land in a family emergency, I would be forced to sell for much less, what we call “distress sale”. In this state of economy any sale is going to give the assets at throw away prices.”

Chirashree Dasgupta, Prof, JNU explained “the idea that the private sector is efficient and dynamic, is inherently flawed. They (the Govt) know that they are not going to be able to sell outright is that’s why they have adopted this policy of monetisation. The economy is in a crisis of demand- user charges on all public infrastructure will rise, everything will become more expensive, there will be less money in people’s pockets. The share of profits will increase at the cost of the share of wages.”

S. Nagalsamy, Former Principal Accountant General, TN & Kerala, talked about the technicalities behind the NMP. “The funds are going to be from the banks, but the profit is going to go to the private investors, the ultimate sufferers are going to be the users. NMP has not started now. It started long ago, the Govt has already made several amendments in the regulatory acts to facilitate the private players.”

Priya Dharshini, from CFA pointed towards the endangerment of job security and the social responsibility towards the marginalised. “Though they promise employment, there are not going to be any jobs. The Govt itself is going for contract jobs. There is going to be no job security for the employees of the private sector. What will be the effect on gender? The male to female employee ratio was 10:1 in one study done with corporates. And the companies hardly disclose this. It is worse for the people with disabilities.”

R Elangovan, Dakshin Railway Employees Union (DREU), says the NMP is linked to the National Infrastructure pipeline, which was a 102 lakh crore project. Where some investment was to be done by the Govt while some by the private. Now if you look at the railways, 87% investment was done by the Govt itself! The private sector is not interested in investing in the railways. They are only interested in profits.

Dr. Sharat Kumar, from the Dept of Public Enterprises, said “What I see foremost is a confusion and hype around the confusion. Certainly, monetization is a misnomer, but this is also not privatisation. The problem is infrastructure financing. There is a dearth of infrastructure companies in India. We need partners in this venture.”

Every speaker emphasized the need to steer clear from the facade and wordplay around “lease” and “monetisation” and said that we must call it by its name. They spoke of the necessity to raise alarm regarding this brazen privatization that is going to hurt the poor the most. People First called for the need for a People’s Commission to be held on the monetisation and requested wider support in that process.

_____________________________________________________________________________________

Financial Accountability Network is a collective of civil society organisations, unions, people’s movements and concerned citizens to raise the issues of accountability and transparency of the national financial institutions. It also looks critically at the economic and financial policies that have an impact on the people.

People First is a platform of Public Sector Unions, former civil servants, civil society organisations, movements that raise issues of governance, against privatisation of Public Sector Enterprises and for electoral reforms.

———————————————-

For more information, please contact:

Priya Dharshini (+91-9311548645)

Financial Accountability Network India (FAN India, https://www.fanindia.net)