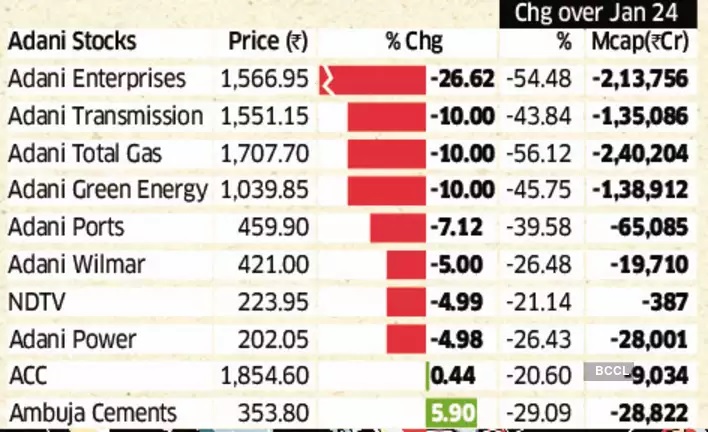

The bleeding of Adani’s market capitalisation reminds us that investment in stock markets is not only a matter of tricks but also it requires full-time engagements. You cannot become a part-time investor and a full-time gainer. Once you go to the office of any bourses, the successful trader and investor would tell you that to become successful in the stock market you have to understand that trading is 80-85% psychological and 15-20% methodological (it is one’s methodology, be it fundamental or technical). There must not be a psychological block to good trading and money management.

Had it been purely methodical CFAs (Chartered Financial Analysts) and CMTs (Chartered Market Technicians) would have ruled the world. Algo traders would have made it a profitable business instead of its classical nature being a zero-sum game. A man who would have the latest technical analysis software would have made a good fortune and the man with limited resources would have lost all the time. It is, therefore, a man who has limited methodology but control over the psychological prospects can make lots of fortunes. One would hardly find any trader who made fortune in every single trade but finding traders engaged in more losing trades than winning ones is easy.

https://economictimes.indiatimes.com/markets/stocks/news/adani-stocks-continue-to-fall-mcap-loss-widens-to-rs-8-79-lakh-crore/articleshow/97565371.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

The question that comes to mind is if losing trades is destined then why stock markets? The answer is obvious it is money management and careful evaluation of the risks protected by realistic steps that keep one out of trouble and ensures that the big move shall be her. The golden rule is not to jump on the bandwagon; be slow and steady. Investors must learn the way to hold a short-term winner for a longer-term gain coupled with dexterity in when to cut one’s losses by buying and selling at the right time. It is all a psychological game; one which is being ignored by the majority. And, the first terra firma is making the plan with disciplined execution. One makes plans for vacation but when it comes to trading then whims prevail leading to disaster.

The current market price is the resultant force of belief who decides to trade at a particular price thereby giving birth to the buy and sell trade. Mark Douglas in his seminal work “The Disciplined Traders” argues, “What you believed about the value and your reason for believing it may be of the highest quality, but if the market doesn’t share your belief, it doesn’t really matter how ‘right’ you are based on your superior reasoning process or what you believe to be the quality of your information, because prices are going to go in the direction of the greatest force.”

Taking a clue, the writer of these lines possesses several degrees, including but not limited to CFA, and having exposure in the stock market, it could be proclaimed with authority that degrees, IQ, intellect, and analytical skills are of no use once the investor cannot read the psychology of the market. Academic credentials shall go to waste once the market moves against one’s position. Reputation and credentials work only to the extent market moves according to one’s position, otherwise, these do not bother to make one profit.

The live example is Adani’s market capitalization. Keeping fundamentals on one side and news on another side, it could easily be found that news leads the market to move towards the position of the trade forces that reacted with the news. The fundamentals vanish and technical hangs. Those who hoot the press met with hell. It is a misconception that taking a long position in fundamentally strong companies for longer periods makes one safe and the place of psychology checked. For those who have invested for long terms psychology plays an important role. Keeping portfolios strong and in tandem with the market position remains a challenge. One who makes long-term investments and sleeps but whose portfolio grows with the market cannot be infallible as he is right because the market is right.

The greatest investment advisor of all time, Benjamin Graham says ‘time’ is the essence of investing in his seminal work “Security Analysis”. Quoting in verbatim, “… four major factors may be said to enter, either expressly or by implication. These are 1. The Security, 2. The price, 3. The time, 4. The person, which means psychology, must be given importance. How would you ascertain time? There is no such method except psychology. There is nothing to believe in the market, “And this too shall pass away”.

In recent decades we have seen that the more fundamentally strong the company is the more fluctuations in its shares are. The reason behind that investors are now merely investors in their psychology contrary to earlier beliefs where they considered themselves both owners and investors. There are successful investors too who have added satisfaction from the thought that their positions are opposite to those of the crowds by selling their positions as stock advances and buying bonds and vice versa; again the control on psychology comes into the picture.

The effect of emotional and cognitive factors could not be overruled on bourses; a vivid example is the demise of Rakesh Jhunjhunwala where the market gave him last respect by remaining high throughout the day whereas the market was in declining trends a trading day ago. Greed, fear, anxiety and excitement play a prominent role and the government intervention is just icing on the cake. The incidence in the US affects Indian bourses as the investors overseas have a powerful force of market psychology. The ability of psychology to trigger periodic boom and bust cycles in financial markets is well documented and known as ‘animal spirits’ as coined by the economist John Maynard Keynes in his book “The General Theory of Employment, Interest and Money”. He writes:

Most probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits – of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities. … Thus if the animal spirits are dimmed and the spontaneous optimism falters, leaving us to depend on nothing but a mathematical expectations, enterprise will fade and die; – though fears of loss may have a basis no more reasonable than hopes of profit had before.”

It is known to every finance professional that the efficient market hypothesis is being criticized on the pretext that it considers the participant’s rationale. Animal spirits have not been discounted.

There are two methods of security analysis viz fundamental and technical. Only technicals consider market psychology. Nowadays some quantitative methods also consider trends and therefore make profits: hedge funds are one of them. Thus, before making any decision for any security, keeping market psychology into consideration is incumbent failing which there is a chance that capital would be eroded.

The writer is a Kolkata based financial analyst